Executive Summary

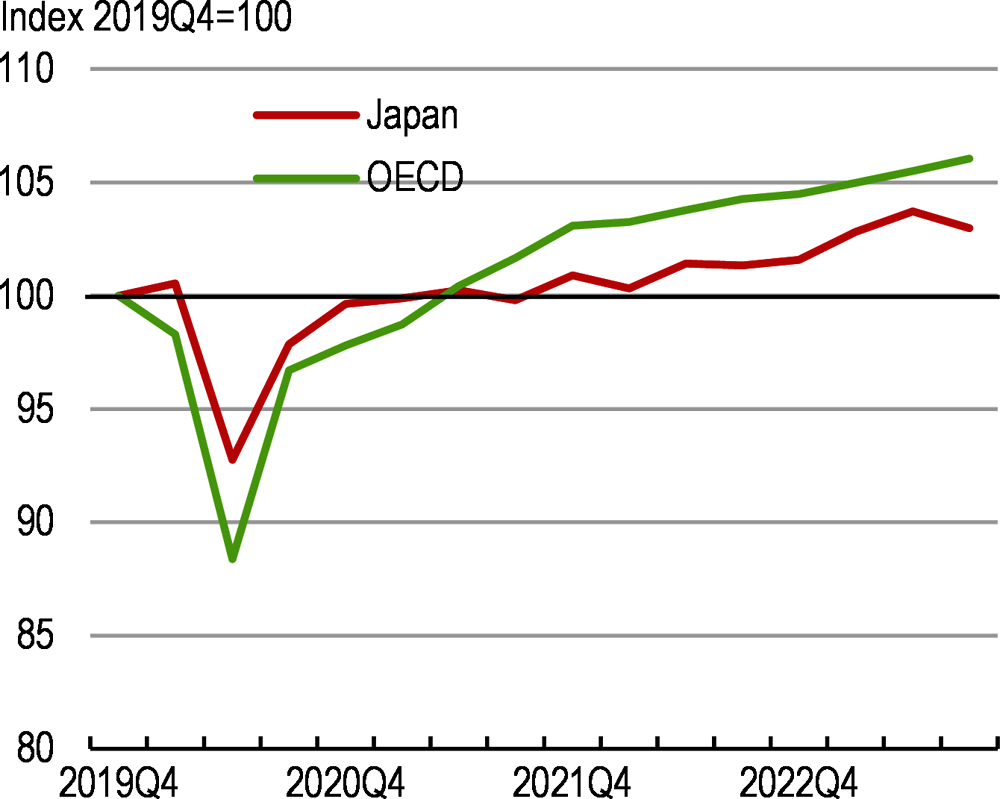

Global economic, monetary and financial sector developments have increased risks and uncertainty. The ongoing recovery, supported by supply-chain improvements, rising tourist arrivals, the release of pent-up demand and accommodative policies, has recently lost momentum (Figure 1).

Domestic demand will remain the main driver of growth as global uncertainty weighs on external demand. The labour market will remain tight, contributing to higher wage growth in 2024-25. Rising wages, government subsidies and the new fiscal package will support private consumption and investment.

Risks are mainly external. The main downside risks relate to the global outlook, geopolitical tensions and renewed supply-side constraints. On the upside, tourism and domestic consumption could recover more strongly than expected.

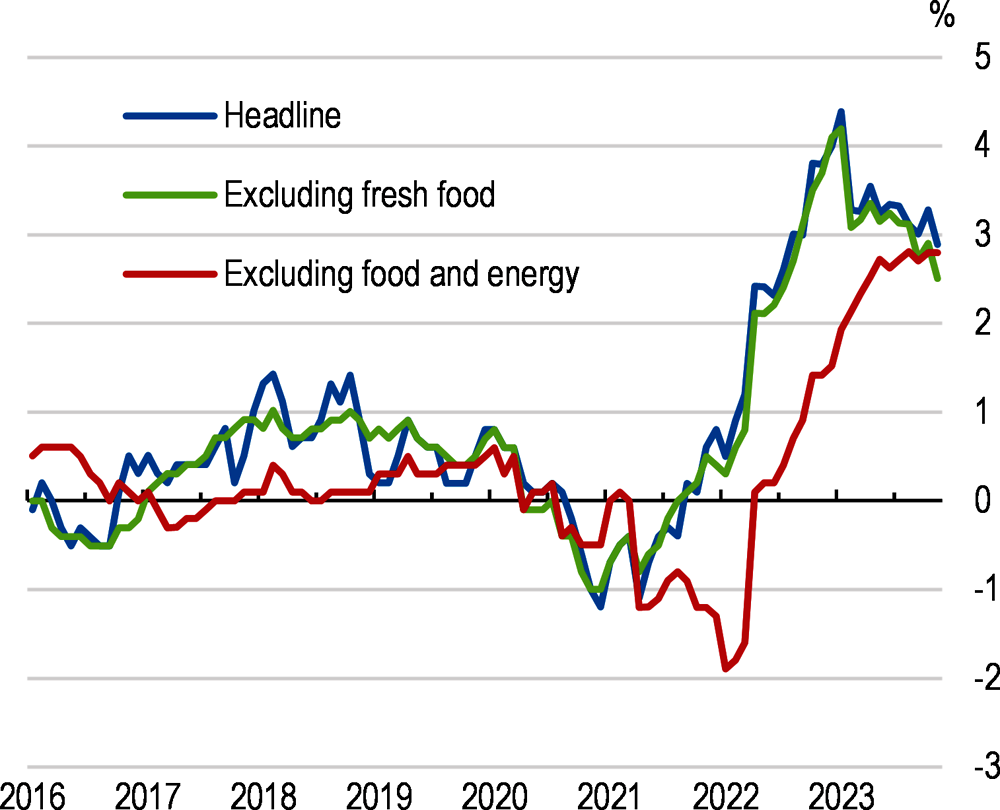

Japan is at a turning point, with inflation more likely to settle durably around the 2% inflation target than at any time since its inception. Following a long period of low inflation, consumer price inflation excluding fresh foods, which is the measure the Bank of Japan uses to guide its monetary policy, has exceeded the 2% target since April 2022 (Figure 2). The strong outcome of the latest annual spring wage negotiations, the highest in three decades, is a step towards achieving a virtuous cycle of redistribution and growth, and monetary policy normalisation. Headline and core consumer price inflation are projected to be around 2% in 2024-25 as government subsidies end, the output gap closes and wage growth gains traction (Table 1).

Divergent monetary policy from peers creates pressures. The short-term policy interest rate has remained unchanged at -0.1%, but yield curve control has become more flexible since December 2022. Greater flexibility in the conduct of yield curve control and a gradual modest increase in the short-term policy interest rate are warranted, based on projections of sustained inflation and wage dynamics. However, uncertainty around inflation is high.

Banks seem resilient in the near term, but risks should be monitored closely. Potential vulnerabilities include the phase-out of emergency support measures, increased foreign interest rate and foreign loan risks, a high share of floating-rate housing loans and rising debt-to-income ratios. Policies to support mergers and improve business models of regional banks, amidst demographic headwinds, should be continued.

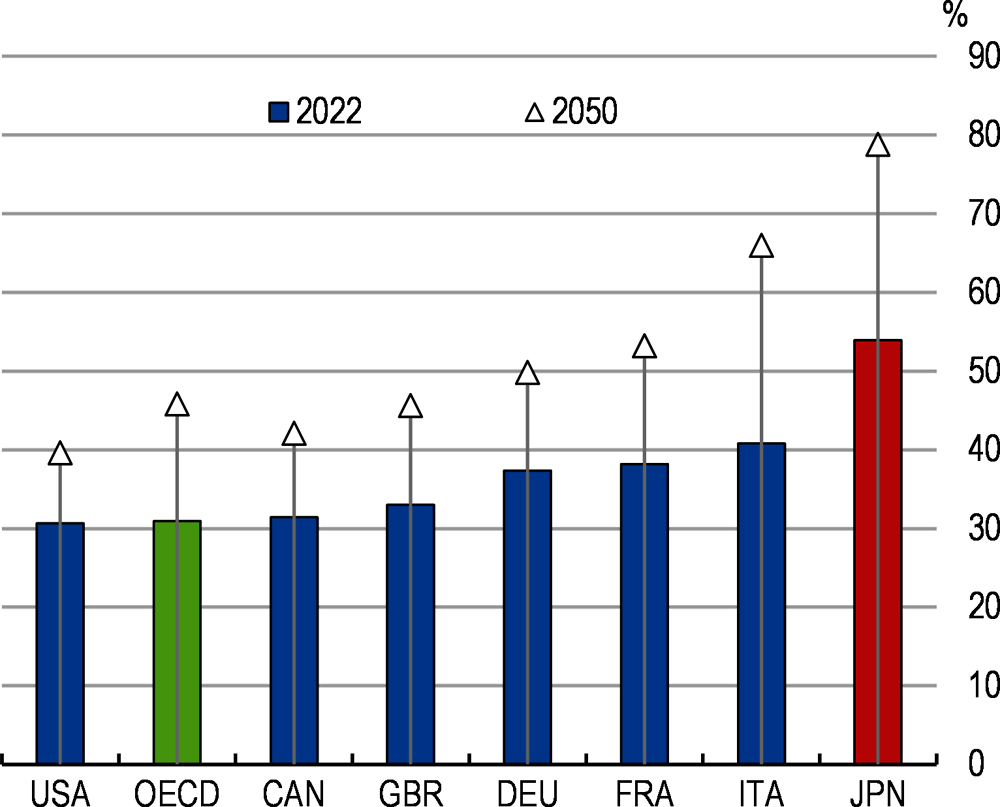

Rebuilding fiscal buffers and ensuring debt sustainability should be prioritised, in a context of increasing debt service risks associated with a possible rise in long-term interest rates. Rapid population ageing is putting pressure on spending, increasing the already large transfers to the elderly.

Fiscal support to address the pandemic and the energy shock has increased gross public debt to an unprecedented level of almost 245% of GDP in 2022. Remaining measures to provide support against the energy shock should be targeted, with a view to phasing them out. Overreliance on supplementary budgets and contingency reserve funds lowers the transparency of fiscal projections and targets. Announcing concrete revenue and expenditure measures to enable a medium-term fiscal consolidation path would boost the credibility and sustainability of fiscal policy.

Containing spending growth requires health and long-term care reforms. Lengthy hospital stays and a high number of medical consultations suggest room for efficiency gains in providing high-quality care to Japan’s ageing population. Reform priorities include boosting out-of-pocket payments for the more affluent elderly through means-testing, and shifting long-term care out of hospitals.

Japan should rely primarily on the consumption (value-added) tax to boost revenues. The current 10% rate is among the lowest in the OECD. In addition, various deductions to personal income taxes erode the tax base. Tax reforms should be accompanied by targeted support measures for low-income households.

Reforms to improve the innovation framework and incentives for start-ups are key to boost productivity and potential growth and address ageing pressures.

Public support to R&D investment is high, but better diffusion of innovation is needed. SMEs only account for 6% of total R&D expenditure. The existing R&D tax credit is not immediately refundable and cannot be carried over, which reduces its effectiveness in stimulating innovation of young and innovative firms with limited tax liability.

Business dynamism is weak, with relatively few start-ups. The government plans to reduce the use of personal guarantees as collateral, which can help improve financing conditions for start-ups and reduce reliance on government guaranteed loans. Improving conditions for innovation capital, such as the undersized venture capital, and encouraging the use of mergers and acquisitions, can help overcome size-related barriers to growth.

Achieving net-zero emissions by 2050 will be challenging, given heavy reliance on fossil fuels. Renewables only account for 11% of total energy supply and 22% of total electricity supply.

The government plans to use a mix of green investment, innovation and carbon pricing to meet targets. The commitment to gradually increase carbon prices from low levels and introduce an emission trading system should be followed through. The details of carbon pricing should be announced well in advance and the design should follow international best practices and provide sufficient incentives and certainty to incentivise private investment.

Projected contributions to emission reductions from innovative technologies, which are not yet cost effective, and nuclear power come with uncertainties. Given changing technologies, mapping out energy scenarios and roadmaps considering different futures for the development of energy sources is key.

The ongoing efforts to boost the modest contribution of renewables to electricity supply, which is partly due to fragmentation in the electricity system, should be stepped up. Enhancing the electricity grid would help meet climate goals and increase energy security.

The projected decline in the population and employment should be mitigated by policies to reverse the fall in the fertility rate, remove obstacles to the employment of women and older persons and make greater use of foreign workers.

The government has placed reversing the fall in the fertility rate among its top priorities and plans to double its budget for child-rearing policies. The fertility rate is down to 1.3 and demographic projections based on unchanged policy assumptions point to a decline in Japan’s population by about a quarter by 2060. The old-age dependency ratio is projected to reach 79% by 2050 (Figure 3).

Policies to support families and children, including improving work-life balance, could help reverse the decline in the fertility rate. The take-up and duration of parental leave by fathers is low, reflecting reduced earnings during the leave, concerns over negative career repercussions and the limited ability of SMEs to finance parental leave. The planned increases in spending on early childhood education and care should ensure quality and sufficient staff.

Past labour market reforms have raised employment, but more is needed to break down labour market dualism. The high share of young and female workers in non-regular jobs, with lower wages and career prospects, can delay family formation, weaken female labour force participation and contribute to the gender wage gap. Continuing Work Style reforms, including equal pay for equal work, would also support working conditions for older workers who are shifted to non-regular status at age 60. Social insurance coverage and training gaps between regular and non-regular workers should be lowered further.

Japan’s traditional labour model of lifetime employment, a seniority-based wage system and mandatory retirement discourages the employment of older and female workers and labour mobility. Abolishing the right of firms to set mandatory retirement, typically at 60, would increase employment and weaken the role of seniority in setting wages, which would also benefit women and younger workers. Raising the pension eligibility age beyond the target of 65 in line with increasing life expectancy would also strengthen work incentives. These reforms should be accompanied by measures to re-skill older workers, whose participation in lifelong learning is relatively low.

Coping with population decline also requires building on recent policies to increase the role of foreign workers, which remains low, albeit rising. Offering long-term residency to workers and their families would make Japan more competitive in attracting more and higher-skilled foreign workers. Broad policies to increase the integration of foreign workers should be prioritised.