Executive summary

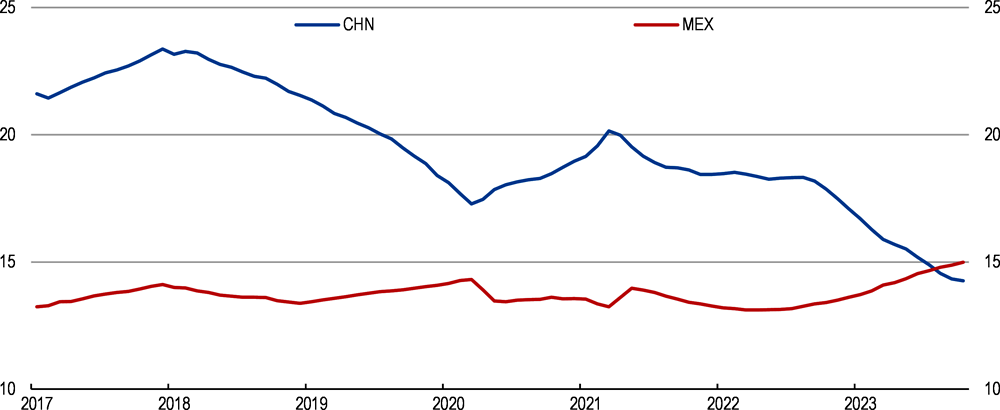

The economy is navigating well the uncertain global economic environment. Headline inflation is gradually receding, but core inflation is persistent. Mexico has started to benefit from nearshoring (Figure 1), but fully harnessing its potential requires tackling long-standing challenges such as low productivity, and high inequalities.

Growth has held up well thanks to a resilient domestic demand. Consumption is supported by a strong labour market. Investment is trending up, supported by public infrastructure projects in the south and by private investment in machinery. Exports have kept their dynamism.

Monetary policy reacted decisively to high inflation. Headline inflation has softened and core inflation, while being more persistent, has also gradually fallen, although services inflation remain high. The strong appreciation of the peso has contributed to contain inflation.

GDP growth is expected to decelerate to 2.5% in 2024 (Table 1). Domestic demand will sustain growth, while exports will suffer from the slowing in the United States. Headline and core inflation will continue slowing down. A sharper deceleration in the United States and more persistent inflation than anticipated, requiring keeping rates high for longer, are key downside risks. On the upside the ongoing reconfiguration of global value chains could boost investment more than anticipated.

Fiscal policy has a robust track record in attaining fiscal targets and keeping public debt low. However, higher tax revenues are needed to keep fiscal prudence and to address important spending needs in productivity enhancing areas, such as education, infrastructure, the digital and green transitions, and the fight against corruption and crime. Moreover, upgrading the fiscal framework would facilitate providing support during downturns.

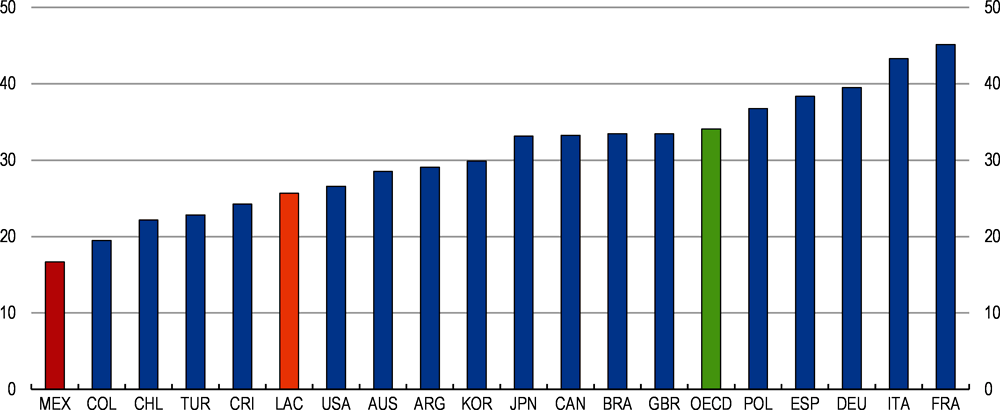

Mexico has the lowest tax-to-GDP ratio in the OECD (Figure 2). There is room to raise more revenues from the property tax, environmental taxes and to make the tax system more effective and progressive by reducing tax expenditures benefiting the more affluent. Boosting public spending efficiency could also free up additional resources. This will require a more systematic use of cost-benefit analysis in infrastructure projects and systematic evaluations and wider use of means testing in social programmes.

The fiscal framework’s ability to deliver countercyclical fiscal policies is limited. Existing fiscal rules encourage pro-cyclical fiscal policy, as they favour discretionary and sharp cuts in spending to achieve fiscal targets. The coverage of the spending rule is too narrow to smooth spending over the cycle. The lack of a medium-term budget framework implies an almost exclusive focus on next year’s spending allocation and fiscal target during budget preparation and discussion.

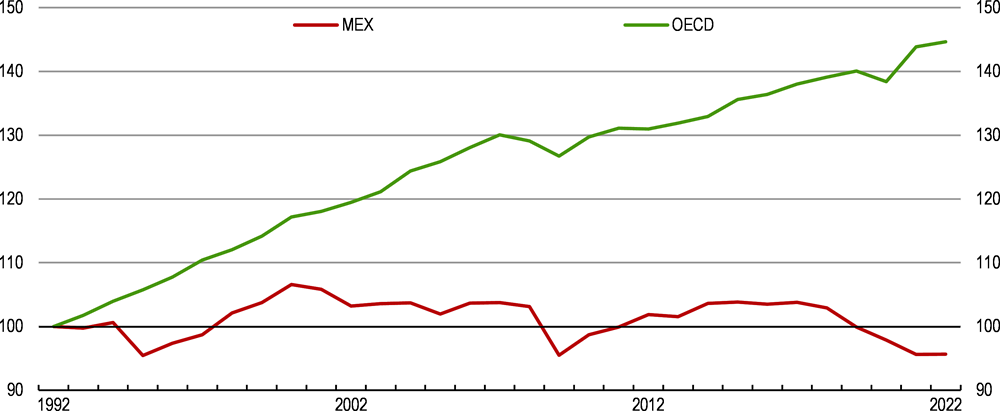

Mexico has large potential to attract investment from companies looking to relocate their operations to North America. This is also a significant opportunity to spread the benefits of trade throughout the country, integrate SMEs more forcefully into trade and to create more and better value chain linkages. Fully harnessing these opportunities will require tackling long-standing challenges, such as low productivity (Figure 3), and shifting to renewables and improving water management.

Boosting digital connectivity can help to connect regions and SMEs into trade. Despite recent investments in digital infrastructure, many parts of the country still lack access to high-speed internet and other digital services, and broadband penetration is relatively low. Multiple government agencies and regulatory bodies are involved in overseeing different aspects of the sector. The telecommunications market is highly concentrated.

Perceived corruption is high. Mexico has been making efforts to fight corruption, including through the launch of a National Anti-Corruption System, but strengthening anti-corruption agencies, including at state level, remains a priority. Increasing the share of public procurement undertaken digitally and limiting direct awards of contracts could help to reduce opportunities for corruption.

Making the most out of nearshoring requires shifting to renewables. With global manufacturing activity increasingly seeking to decarbonize its production processes, Mexico’s abundant renewable energy resources could be a substantial competitive advantage. However, the share of electricity generated from renewable sources remains low. Private renewables generation has suffered from high regulatory uncertainty. Mexico is highly vulnerable to extreme climate related weather events. Increasing the share of renewables in the energy matrix would significantly reduce emissions.

Efficient water management would enhance the reliability of water supply and safeguard the country's limited resources. By reducing operational risks and costs and promoting environmental sustainability, it would make Mexico an even more appealing destination for nearshoring. Water governance is highly fragmented, hampering policy coordination and accountability.

Despite important improvements, inequality remains high in Mexico. Improving education outcomes and reducing gender gaps and informality would help to continue the recent fall in income inequality, while also strengthen the country’s growth potential.

Efforts to enhance human capital should be stepped up. Access to education is nearly universal but still too many students leave the education system without completing secondary education. There is also a need to boost education quality, which suffers from large regional differences. Dual vocational programmes are being gradually deployed with positive outcomes.

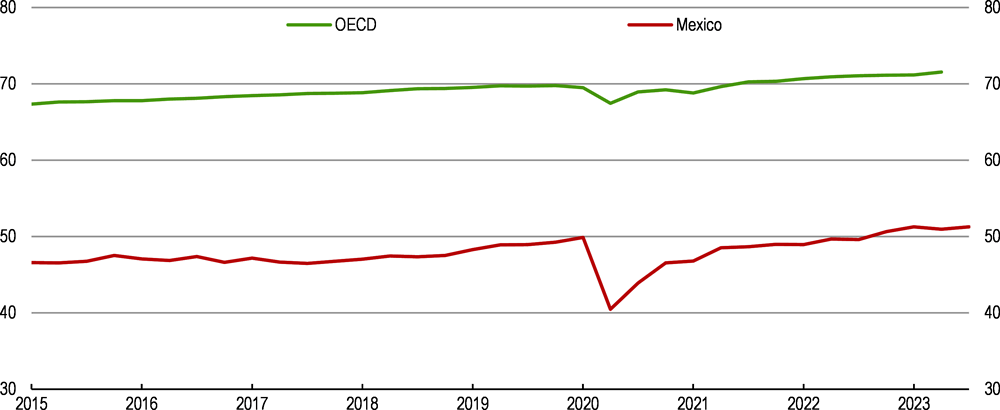

Despite a recent increase, female labour participation is low (Figure 4). Domestic and care responsibilities fall disproportionally on women, hampering their prospects to complete education or be in the labour force. Plans for establishing a federal early education and care network should be prioritised. Expanding elderly formal care services would also support female labour market participation at a limited budgetary cost.

Recent labour market reforms have increased inclusiveness, but informality remains high. Reforms to enhance conflict resolution, workers representation and collective bargaining are paying off. Actions are needed in different policy areas to reduce informality further, which affects more than half of the labour force.

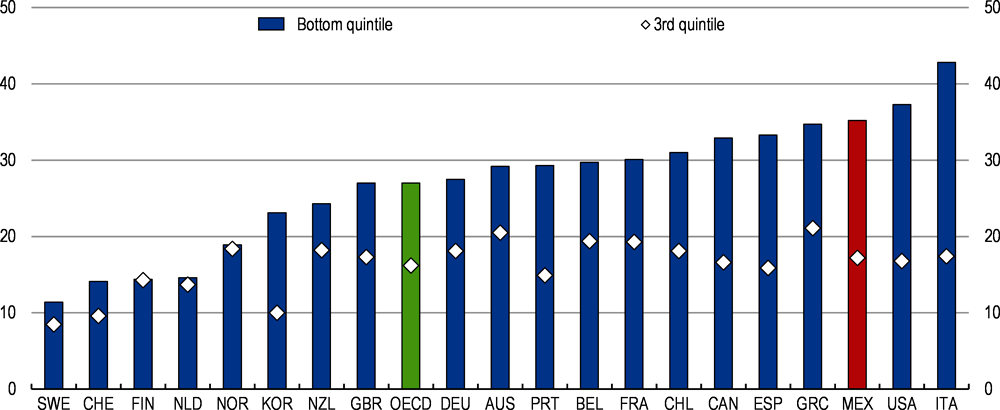

Housing supply has increased but quality is low. Around one dwelling out of four has poor construction material, is overcrowded, or lacks basic facilities. Purchasing a house is a challenge for low to middle-income households (Figure 5). Housing policies have become more targeted towards low-income households.

The size of the rental market is small and low-income households access to credit limited. A strong preference for homeownership and a housing policy biased towards acquisition contribute to the limited size of the rental market. Access to credit by low-income households, where informality is prevalent, could improve by using alternative information (e.g. regular payment of utility or phone bills) to assess creditworthiness.

Ensuring that housing and urban development policies are coordinated is key. Administrative fragmentation prevents local policies from aligning with national targets and weak inter and cross-government coordination provokes disordered urban development and spatial segregation. Municipalities often lack the technical capacity to attend the urban development challenges.

Large commuting costs hamper access to jobs and living conditions. Massive transport remains a marginal mode of transport in Mexico, except for Mexico City. The public transport system is based on a weakly regulated model with many small private concessionaires running low capacity and old-technology minibuses.